10 Ridiculously Simple Financial Tips That Will Make You Rich

Managing your finances can be a bit overwhelming, especially when you’re young. However, developing good money management habits now will lead to your long-term success! Here are 10 simple financial tips that will MAKE YOU RICH!!

RELATED: 8 Money Hacks to Get Your Finances Back on Track

Some of the links in this post are affiliate links. We may receive compensation when you click on links to products at no extra charge to you. View our full disclaimer.

10 Ridiculously Simple Financial Tips That Will Make You Rich

1. Learn from the Experts

When rich people have questions about how to manage their money, they seek out financial advice from experts. They value the knowledge these experts offer through books, blogs, workshops/courses, newspapers, videos, and one-on-one discussions.

Rich people weren’t always rich. Well – some might have been. But many had to build their wealth from the ground up. They are happy to share their shortcomings with you so that you don’t make the same costly mistakes.

Learn personal finance tips from them!

A few of my favorite personal finance books are:

- Smart Women Finish Rich

- Rich Dad, Poor Dad: What The Rich Teach Their Kids About Money – That the Poor and Middle Class Do Not!

- The Total Money Makeover

- The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

All of the steps below are insights from financial experts. If you want to be rich, you have to think and behave like a rich person!

2. Set a Budget (and stick to it)

Many people feel a budget is a bad thing; however, I’ve discovered that it can be incredibly freeing (when done the right way). Instead of letting money be your boss, you should be the boss of it!

Telling your money where to go will give you more freedom than you may expect. Gone are the days of feeling bad for eating out. If you set aside money for eating out or treating yourself every now and then, that’s okay. The problem is when you spend money freely, without telling it where to go. Next thing you know, you won’t have enough money to cover your monthly bills.

Each month, create a budget where you give every dollar a name and tell it where to go. Getting started with a budget is easy. Check out my simple, step by step guide on how to create a budget that works here.

3. Track Your Spending

Along with budgeting, it’s important to track where you’re spending your money. Even if you don’t stick to the budget 100%, you should continue tracking your expenses. This will help you see areas where you are wasting money.

Rich people monitor their spending habits and make tweaks if they feel they are over or under-spending in certain categories.

Do you know how much you spend on groceries each month? You should!

4. Pay Yourself First

Many rich people will tell you that they always pay themselves first. What does that mean? You should be saving a portion of your income BEFORE you pay bills or spend it on groceries, gas, etc.

As soon as you receive a paycheck, put a specific dollar amount or percentage in a separate savings account. It’s even better to make this process automatic. You won’t even notice it’s gone!

For example, I automatically save $50 per paycheck in a sinking fund. It goes directly to my credit union savings account, so I never see it in my regular checking account. Since the money in the credit union is more difficult to access, I’m less likely to spend it carelessly.

5. Avoid Lifestyle Inflation

It may surprise you to learn that your neighbor is incredibly wealthy. That’s because many rich people live below their means.

They live in modest homes, wear the same clothes every day, and drive older cars. When the shiny new electronic comes out, they are not quick to pull out their wallets. Instead, they continue to use items until they no longer work properly.

I’m sure you’ve heard the phrase, “keeping up with the Joneses.”

Stop trying to impress people you don’t really care about! One thing to keep in mind is that the people who “have it all” are either buried in debt, or they’ve worked really hard to earn what they have.

When you get a raise, bonus, or come into an inheritance, continue to live like you make less than you earn. Depending on your financial goals, take the extra funds, apply it towards debt, invest it, or make a charitable donation.

Don’t worry about people making fun of you because you don’t have the latest smartphone or drive a brand-new car.

One of my favorite Dave Ramsey quotes is, “If you will live like no one else, later you can live like no one else.”

6. Set ambitious financial goals

It’s important that you set goals in every aspect of your life, especially your finances.

Goals should be S.M.A.R.T. – Specific, Measurable, Attainable, Reasonable, and Timely.

To stay on track, re-evaluate your goals each month or every quarter. If you’re close to achieving a goal, aim even higher! Don’t ever get comfortable simply meeting your goals; you want to exceed them!

RELATED:

How to Use a Vision Board to Reach Your 2018 Goals

7. Invest Your Money

Investing can be scary when you’re first starting out. However, there are many resources that can help you! Start with one of these books: Rich Dad, Poor Dad, The Essays of Warren Buffet: Lessons for Corporate America, or The Intelligent Investor.

You should start investing as early as you can so that your money has more time to grow. At a minimum, you should put a portion of your income into a high-interest savings account. Next, begin investing in stocks, bonds, and mutual funds.

If you’re patient and a go-getter, you could also invest in goods that will appreciate in value, meaning you can sell it for a higher price than you paid for it. Examples include artwork, baseball cards, beanie babies, etc. 🙂

If you are consistent, even small investments can grow into a huge nest egg many years from now!

Regularly track your investment portfolio with the free app, Personal Capital!

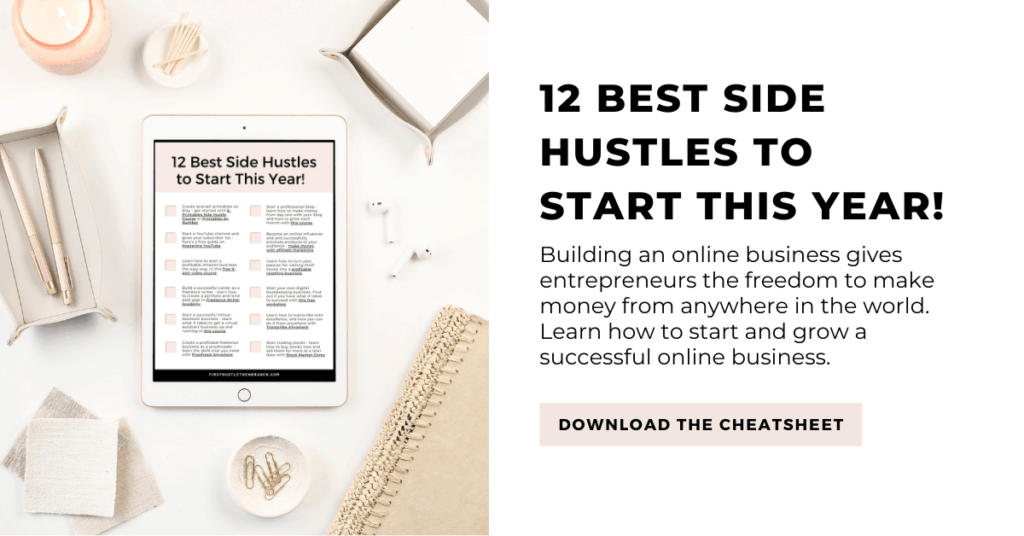

8. Get a Side Hustle

You’ve probably noticed that rich people have multiple streams of income. Therefore, you should have a few side hustles of your own!

You should never rely solely on one source of income, as it may not always be there. Lessen your risk by adding multiple sources. Work your day job, but start a business on the side, rent out real estate properties, walk dogs, babysit, etc., to make extra money.

Not only will side hustles lessen your risk, but they could also help you accomplish your financial goals more quickly.

RELATED:

12 Incredible Ways to Make Money Online

9. Save as much money as possible

Become one of those people that refuses to pay full price!

Turn saving money into a game. I love looking at the “Money Saved” section at the bottom of my receipts. Try to beat your savings with each shopping trip! Cut the cable cord. Get a roommate.

Learn how to save money on groceries in the free Grocery Budget Makeover Workshop!

Or, use one of these services to help you save HUNDREDS of dollars on your expenses each month:

Use coupons, cut back on Starbucks, plan social events after mealtimes, make meals at home, etc. There are many ways to start keeping more of your hard-earned money!

10. Stay out of debt

Rich people get out of debt as quickly as possible and avoid creating more debt! If you cannot pay your credit card balance in full each month, do not use your credit card. If you know you will spend uncontrollably, cut it up. Do not take out any new loans.

You may have heard the terms “bad debt” and “good debts.” Sure, debt can be leveraged to help you achieve some financial goals. However, if you find yourself living well beyond your means, create a plan to start paying off debt – the “good” and the “bad.”

For example, order your credit card debts from highest interest rate to lowest interest rate. Pay off the credit card with the highest interest rate first. Then work towards paying off your car loans and student loans. Most people save their mortgage for last.

As you pay off debt, your credit score will increase, which is helpful if you plan to make a large purchase in the future. One of the best ways to stay out of debt is to only use cash. This system doesn’t work for everyone, so it’s best to test it out for a month or two. Find a cash envelope system that works best for you, or use your debit card for every purchase.

If you want to be rich, imitate rich people.

Developing a financial plan will allow you to create a bright future – debt-free and wealthy! These 10 simple steps will help you get started!

Let me know which tip you’re focusing on in the comments below!