How to Build a Starter Emergency Fund

A recent study found that 61% of Americans do not have enough savings to cover a $1,000 emergency.

Building an emergency fund is one of the most important things you can do to secure your financial future! It may sound counter-intuitive to save money before paying off debt, but you need something (besides credit) to fall back on if unexpected expenses come up. In the past, I used my credit cards for “emergencies,” but that just added to my debt, making things even worse.

Tonya Rapley from My Fab Finance once said, “Your emergency FUND is not for emergency FUN!”

You must commit to not touching your emergency fund. To do this, you need to understand what counts as an actual emergency.

Some of the links in this post are affiliate links. We may receive compensation when you click on links to products at no extra charge to you. View our full disclaimer.

What is an emergency?

You lose your job, or your boss cuts your hours.

A family member (including pets) has a medical emergency.

Your car breaks down and needs repair so that you can get to work.

What is NOT an emergency?

There’s a semi-annual sale at your favorite store.

Your friends are planning a weekend trip, but you don’t get paid for another week.

Your property tax is due soon, and you forgot about it.

Emergencies are things you truly could not have planned for or predicted. You can budget for the items on the right.

How to Build a Starter Emergency Fund

Open a new savings account – I highly recommend using a free, no-fee Ally online savings account, which offers better interest rates than most brick-and-mortar banks (currently 1.45%!!). Using an online savings account also makes it a bit more inconvenient for you to access it. When you can transfer money from your savings to your checking account instantly, you’re more likely to spend your savings on non-emergencies.

However, when it takes 2-3 days to complete a transfer, that makes you think about whether or not there is an actual emergency. Since putting my money in an Ally online savings account, I’ve almost forgotten it’s there, which is great for maintaining my emergency fund! Out of sight, out of mind. Do some research to determine which savings account is best for you!

Automate your savings – In The Automatic Millionaire, David Bach explains how paying yourself first leads to financial security. Determine how much you need to save each week or pay period, and schedule auto-debits to your new savings account. What you don’t see, you can’t miss!

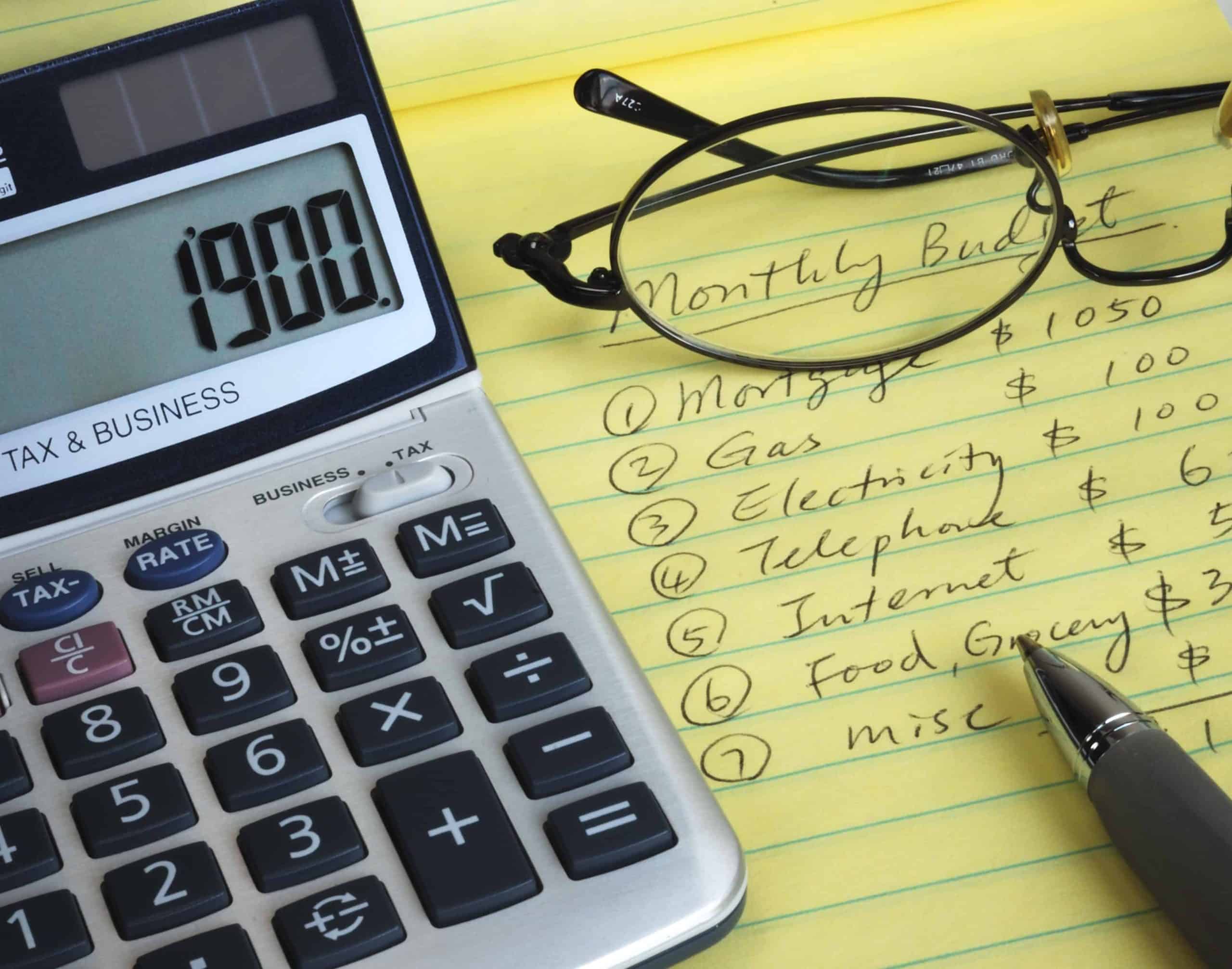

Reduce expenses or increase your income – Trust me, I understand if your budget is a little tight. Squeezing out extra cash for a savings account will be much easier if you can reduce your expenses. After creating a budget, figure out what areas you can cut back on. For example, eat out one less time each week or cut the cable cord and use a streaming service. Once you’ve exhausted all those options, it’s time to increase your income. Try one of these side hustles or get a second job.

Use cash – Commit to using cash-only from now on (or at least while building your emergency fund). I still use a travel rewards credit card for almost all of my purchases. However, I pay it back each week. Do what works best for you, as long as you don’t create more debt! Find a cash envelope system that works best for you.

What Do I Do After I Save $1,000?

Congratulations! Now you can get “gazelle intense” with paying off your debt. If you are debt-free, it’s time to increase your savings goals. Financial experts recommend saving 3-6 months of your expenses (not income).

How do you eat an elephant? One bite at a time. Split your goals into smaller chunks to make them more manageable. You’ll be impressed by how quickly you can achieve them.

What If I Have An Emergency?

Life happens – that’s why we prepare for unexpected expenses! If you need to dip into your emergency fund, don’t panic. Stop paying extra towards your debt or saving for big purchases and focus on rebuilding your emergency fund using the steps above. Once you’ve replenished your emergency fund, you can resume paying off debt aggressively or saving for a home, etc.

Do you have an emergency fund? What are some things you’ve done to build your emergency fund?