7 Smart Ways to Spend Your Tax Refund

Tax season is here!

Some people loathe the months leading up to tax day, while others have already mentally spent their tax refund before they’ve even filed for it! I typically fall into the category of those who don’t care one way or the other. THIS YEAR IS DIFFERENT. For the first time, I have written a plan for how I will use my tax refund to get ahead financially. The IRS reports that the average refund is $3,120. Make this the year you also use your refund to add to your wealth, rather than subtract from it. Here are 7 smart ways to use your tax refund!

Some of the links in this post are affiliate links. We may receive compensation when you click on links to products at no extra charge to you. View our full disclaimer.

7 Smart Ways to Spend Your Tax Refund

#1: Build An Emergency Fund

Before you do anything else, protect your family from unexpected costs you may incur in the future. If you have debt, many financial experts recommend building a starter emergency fund of $1,000. If you are debt-free, your emergency fund should cover 3-6 months of your monthly expenses (not income).

Emergencies will happen – that’s life! However, putting unexpected expenses on a high-interest credit card or taking out a personal loan will only dig you deeper and deeper into debt. An emergency fund will give you peace of mind when emergencies arise because you will be prepared to cover the costs with cash. Saving for emergencies is step one towards financial security.

RELATED: How to Build a Starter Emergency Fund

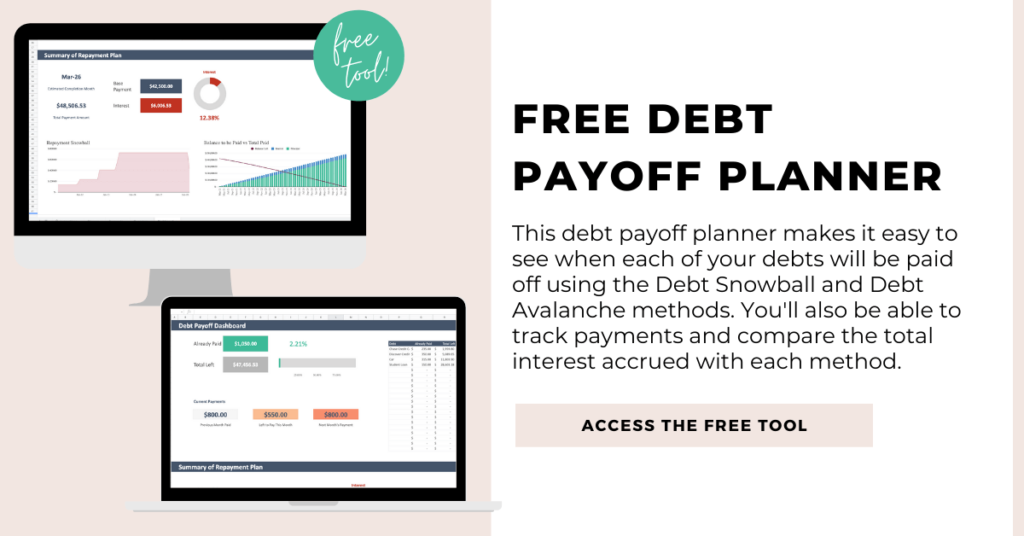

#2: Pay Down High-Interest Debt

The very first thing I’m doing when I receive my tax refund is paying off a credit card with a 24.24% interest rate – yikes! Those monthly payments can only go so far when hundreds (if not thousands) of dollars in interest is being added to the balance each year.

No matter how you accrued your high-interest debt, whether it be mindless spending or paying for your education, you should consider paying off a chunk of it with your tax refund. Doing so will give you the momentum you need to get started on your journey to debt freedom! It could also help improve your net worth. I began tracking my net worth on Personal Capital in January. Although it’s still in the negative, it’s going up! That’s extremely motivating for me, and I’m sure it will be for you as well! Sign up for a free Personal Capital account here.

Bonus: Paying down some of your debt will also improve your credit score! Did you know that your credit score can affect your ability to get a new job, rent or purchase a home, and potentially save you money on auto insurance?!

RELATED: Surprising Ways Your Credit Score Can Impact Your Life

#3: Contribute To Your Retirement Fund

If you’re a recent graduate or young professional, retirement may seem extremely far away and irrelevant. I hate to break it to you, but you will get old. There’s good news though! You’ll retire, travel and enjoy life without a worry in the world! That’s if you save for retirement. But how much do you need to save? Research has shown that millennials (born in 1982 – 2004) will need to save $1.8 million for a 30-year retirement! Given this, you should be contributing as much as possible to your retirement fund. Thanks to the power of compound interest, adding your tax refund to your retirement fund could be very rewarding in the long-run. Read more about how much millennials need to save for retirement here.

#4: Invest In Long-Term Savings Goals

Are you an aspiring homeowner? Do you have dreams of traveling the world? Planning a wedding? Building a college fund for your children? If you won’t need the money for 3-10 years, investing your tax refund will give it a chance to grow at an average rate of return. Some of the best investment opportunities for intermediate-term goals include bank certificates of deposit (CDs), short-term bond funds, and peer-to-peer loans.

#5: Perform necessary maintenance on your home or vehicle

Have you been putting off home or car repairs because you don’t have the money? Sometimes delaying maintenance on your vehicle or home can lead to more costly repairs. It’s important that your vehicle operates properly so it can get your family safely to and from work or school. Be proactive and use your tax refund to cover necessary repairs or replacements. If your home is in tip-top shape, save a portion of your refund for future home improvements.

#6: Pre-pay Your Bills

Do you feel overwhelmed by your bills? Use your tax refund to get ahead of next month’s payments. Doing so will give you some peace of mind, and create a buffer each month. Managing your finances when you’re in debt can be very emotionally draining. Some people have found it super helpful to live on last month’s income. Using your tax refund to pre-pay next months’ bills will give you the best chance to do the same. You won’t have to worry about whether or not you have enough money to cover your bills because you’ll already have it!

#7: Invest In A Side Hustle

You can only cut out or reduce a finite amount of expenses. However, your income opportunities are infinite! I recently read the book, Rich Dad, Poor Dad, where I learned the importance of making my money work for me, rather than me working for money.

Consider using your tax refund to take a course to learn a skill that will allow you to make more money. Start a photography business, become a freelancer, flip houses, or start a blog.

Until December 2017, I had no idea you could make money blogging. I’m talking up to $100,000+ A MONTH! I launched First Hustle, Then Brunch because I wanted to help others who are paying off debt. When I realized I could earn extra money while paying off my six-figure student loan debt, I began monetizing my blog.

I have since decided to learn more about turning First Hustle, Then Brunch into a profitable business. I chose to use a portion of my tax refund to invest in my business by joining Billionaire Blog Club. Paul Scrivens, the creator of BBC, shares all his secrets when it comes to niche selection, Pinterest, SEO, Wordpress, and more!

If there’s a course you’ve been eyeing or a business venture you’ve always wanted to invest in, now is the time to become your own boss!!

RELATED:

While some people are blowing their tax refunds on fancy, new items, figure out a way to make that money work for you! Keep in mind, it is not free money, it’s YOUR money! Choose one or more of these ways to use your tax refund to build wealth and improve your financial situation. Here’s how I plan to spend my tax refund:

- Pay off Credit Card 1 of 2

- Pay off my first student loan!!!

- Invest in my business by joining Billionaire Blog Club

Are you getting a tax refund this year? If so, how do you plan to spend it?